Thanks to the newly enacted Inflation Reduction Act, Rhode Island families are eligible for hundreds of dollars a year in energy savings. This historic legislation will:

- Create millions of good-paying American jobs.

- Put the U.S. on track to reduce emissions by up to 40 percent over the next decade.

Visit the Department of Energy Savings Portal to learn more about potential savings.

To get the most out of these savings, Rhode Island households can take advantage of various tax credits and rebates to help make their homes more efficient, power their homes with clean energy, and lower the cost of purchasing electric and hybrid cars.

The Inflation Reduction Act makes household savings available to constituents, including:

- Up to 30 percent (generally capped at $1,200 per year) in tax credits for energy-efficient home improvements, including heat pumps;

- Rebates for residential efficiency retrofits, electrification projects including heat pumps, cooktops, and other appliances—as well as associated electrical upgrades;

- Up to 30 percent in tax credits for rooftop solar, batteries, geothermal heat pumps, and other property; and

- Up to $7,500 in tax credits for new clean vehicles, and up to $4,000 for used clean vehicles, depending on taxpayer income and other factors.

TAX CREDITS FOR RESIDENTIAL ENERGY EFFICIENCY IMPROVEMENTS

.png)

As a result of the Inflation Reduction Act, Rhode Island homeowners will have access to expanded tax credits for energy efficiency improvements, including certain onsite installation costs.

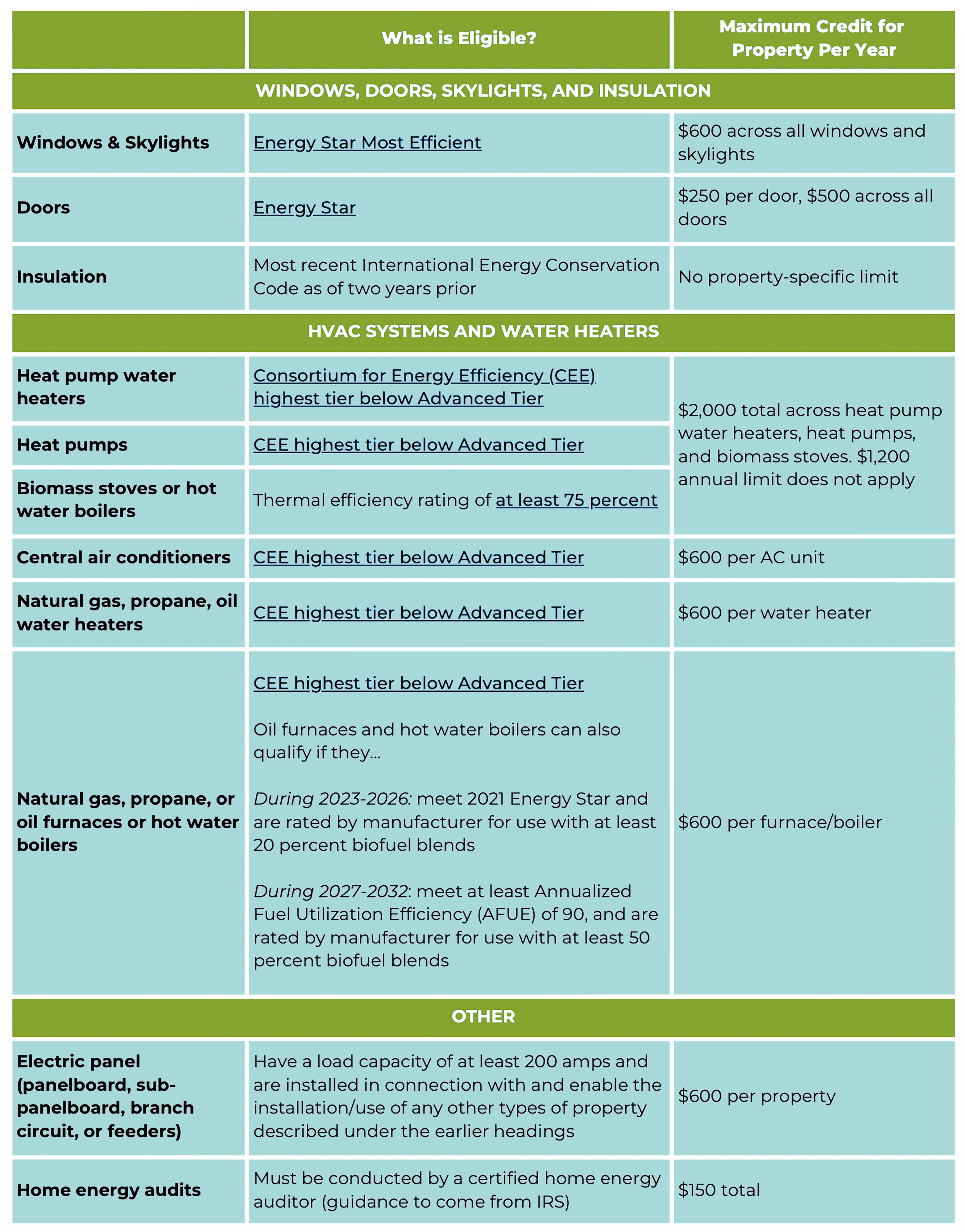

Starting in 2023, homeowners can receive up to 30 percent back through tax credits for making energy efficiency improvements to their home – generally up to a maximum of $1,200 per year but potentially up to $3,200 if improvements include heat pumps, heat pump water heaters, or biomass stoves.

For more specifics on what improvements are eligible, see the table at the bottom of this page.

TAX CREDITS FOR RESIDENTIAL ENERGY PROPERTY

.png)

Rhode Islanders can receive a tax credit of 30 percent of the cost of property for rooftop solar and other residential clean energy systems installed on their homes. Eligible property includes:

- Residential solar and solar water heaters

- Small wind

- Geothermal heat pumps

- Battery storage

- Fuel cells

Eligible expenditures include certain onsite installation costs. Solar expenditures include products such as solar shingles.

If an individual does not have sufficient tax liability to use up the entire credit amount during the year they install the property, they may carry forward any remaining credit to future tax years.

Additionally, individuals may see reduced pricing from community solar or solar leasing options, where the commercial entity takes the business credit for the property, rather than the individual.

MORE WAYS TO SAVE:

Home Energy Rebate Programs: Rhode Island will receive approximately $32 million for the Home Efficiency Rebates (HER) program, and $31 million for the Home Electrification and Appliance Rebates (HEAR) program. The HEAR program is income-restricted and will provide rebates on electric panel upgrades; home wiring improvements; and new electric stoves, induction cooktops, and heat pump dryers. Click here for more details.

Rooftop Solar: Click here to learn more about RI’s new Affordable Solar Access Pathways (ASAP) program and see if you qualify.

The Clean Vehicle Credit: Consumer tax credit for up to $7,500 for individuals to buy new clean vehicles and up to $4,000 to buy used clean vehicles.

Click HERE for frequently asked questions on clean vehicle tax credits.

Qualifying Individuals: The credit is limited to individuals with annual income below: New Cars: $300,000 for joint filers, $225,000 for head-of-household filers, $150,000 for single filers; Used Cars: $150,000 for joint filers, $112,500 for heads of household, and $75,000 for single filers.

Qualifying Vehicles:

- New Vehicles: Individuals with a contract to purchase an electric vehicle signed prior to August 16, 2022 may claim a credit based on the rules that were in effect prior to enactment of the Inflation Reduction Act.

- Starting in 2023, the new vehicle credit is limited to sedans with a manufacturer’s suggested retail price (MSRP) of up to $55,000 and trucks and SUVs with an MSRP of $80,000 or less.

- Used Vehicles: The credit can be used for clean non-commercial vehicles sold for $25,000 or less and older than two years, including electric vehicles and plug-in hybrids.

Click HERE for more information on qualifying vehicles.

EV owners can save thousands in operating and maintenance costs each year compared to gas vehicle owners.

STAY IN THE KNOW:

Consumers can save more than $1,000 per year by taking advantage of these energy efficiency incentives.

Click HERE for frequently asked questions on consumer energy efficiency and clean energy tax credits. For a more comprehensive look at energy savings through the Inflation Reduction Act, visit the White House portal HERE.

Click HERE for area median income lookup tool to see what your income limit is.

Click HERE to calculate how much you could save.

Click HERE to sign up for updates and to find out which programs are available to you.

Click HERE to access Rhode Island Energy, and HERE for the Rhode Island Office of Energy Resources.

MORE DETAILS ON ELIGIBLE ENERGY EFFICIENCY IMPROVEMENTS