NOTE: Following publication of its analysis, JCT revised its findings on 4/23. The latest version of that analysis is available here. These updates do not affect the distributional table below.

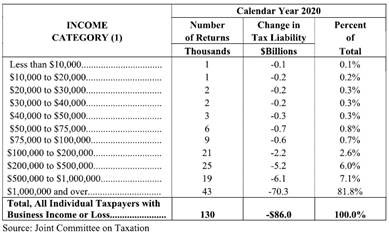

Washington, DC – Senator Sheldon Whitehouse (D-RI) and Lloyd Doggett (D-TX) released analysis today from the Joint Committee on Taxation (JCT) showing a massive windfall for a small group of wealthy taxpayers from a Republican provision in the coronavirus relief bill. According to the JCT, 43,000 individual tax filers covered by one of the provisions would see their tax liability fall by a combined $70.3 billion in 2020. The JCT analysis shows nearly 82 percent of those who will benefit from that provision make $1 million or more, with 95 percent making over $200,000.

“It’s a scandal for Republicans to loot American taxpayers in the midst of an economic and human tragedy,” said Whitehouse. “This analysis shows that while Democrats fought for unemployment insurance and small business relief, a top priority of President Trump and his allies in Congress was another massive tax cut for the wealthy. Congress should repeal this rotten, un-American giveaway and use the revenue to help workers battling through this crisis.”

“For those earning $1 million annually, a tax break buried in the recent coronavirus relief legislation is so generous that its total cost is more than total new funding for all hospitals in America and more than the total provided to all state and local governments,” said Doggett. “Someone wrongly seized on this health emergency to reward ultrarich beneficiaries, likely including the Trump family, with a tax loophole not available to middle class families. This net operating loss loophole is a loser that should be repealed.”

Based on to the JCT analysis, millionaire tax filers benefiting from one of the Republican provisions will see an average windfall of $1.6 million this year alone. That windfall dwarfs the Coronavirus Aid, Relief, and Economic Security (CARES) Act’s $1,200 benefit for working families.

READ THE JCT LETTER TO WHITEHOUSE AND DOGGETT HERE

The changes included in the CARES Act would allow wealthy taxpayers to use losses in certain years to avoid paying taxes in other years. The day after Senate passage of the CARES Act, the JCT published a document estimating that the provisions together will reduce government revenue by $160 billion over ten years. Together, the changes are among the costliest provisions in the bill.

Last week, Whitehouse and Doggett sent a letter to senior Trump administration officials requesting communications that may shed light on the origins of the Republican provisions. According to reports, beneficiaries of the tax giveaways may include President Trump, his son-in-law Jared Kushner, and “real estate investors in President Trump’s inner circle.” Read the letter here.

###